We are going to share how Medicare enrollees can potentially reduce their Medicare Part B premiums.

Medicare Part B Premiums are deducted from Social Security benefits every month upon Medicare eligibility. The premium is variable and dependent on your income. Much like our income tax system in the United States, the more money you earn, the more you pay.

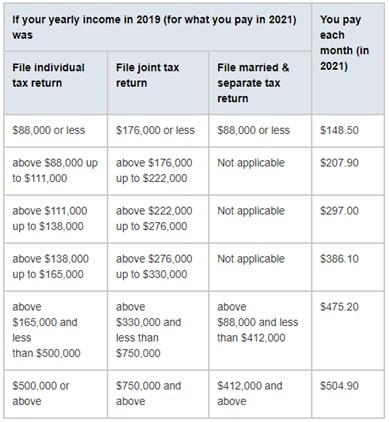

Below is a chart copied from the Medicare.gov website detailing 2021 premium brackets. If this looks a lot like the income tax brackets, it is because it pretty much is.

Most enrollees pay $148.50 per month. However, there are instances where income can be higher and push taxpayers into higher, uncomfortable brackets. Capital gains from non-retirement accounts and Roth Conversions are the main culprits.

With capital gains, we can shelter realization through tax-efficient investment funds; however, with Roth Conversions, the income is nearly impossible to avoid.

For example, we recommend conversions through the 24% federal bracket for many clients. Its reasons are for another time. In this case, payments are often in the $386.10 premium bracket. However, once Roth Conversions are over, we typically see those clients become “ghosts” of their past in the eyes of the IRS. Their income falls below the $176,000 number above, married filing joint, and qualifying them for the lowest Part B premium.

Medicare will only adjust the premium after a two-year lookback, but we have seen cases where the lookback reduces to one year. Successful application of the instructions below can save up to $2,851.20 per year, per person, depending on prior-year income.

- Complete last year’s tax return with the low income. Your tax return is the primary document Social Security will use for consideration in reducing your current year premiums.

- While logged into your My Social Security (ssa.gov) account, call Social Security’s national phone line (800) 772-1213.

- When you have a representative on the line, let them know your income has changed dramatically. You would like to petition for an adjusted Medicare Part B Premium effective January 1st.

- Note, we have reported pushback from Social Security during the call. One client we work with encouraged petitioners to be insistent and not give to any resistance from the Social Security office. The primary goal of this call is to arrange an appointment with your local Social Security Office to review your decreased income and apply for a premium adjustment and pro-rated refund.

- Note, if you are married, you need to go to the appointment together.

- The local office meeting gets a little tricky due to timing. Your tax return for the previous year must be complete and show the reduced income. Technically the application to adjust your premium payment is due in the third week of January but requires last year’s tax return. The deadline is an issue because hardly anyone has their return complete by then. I know our clients do not even get their 1099’s from us until late February. Nevertheless, push through.

- One client mailed the tax return to the local Social Security office before the meeting and said the experience was more efficient than bringing the tax return to the appointment.

- The appointment itself appears straightforward, and we have not heard of any significant issues at the local offices. But, of course, we value all feedback.

- The confirmation comes in three forms. One, your net Social Security check will rise due to the lower premium. Second, you will receive a confirmation letter via US Mail. Last, you should receive a retroactive one-time payment from months going back to January 1st of the current petition year.

In almost all cases, the petitioner got their payments reduced and saw retroactive payments back to January 1st of the petitioned year. The retroactivity, of course, provided a healthy ‘bonus’ once the process was complete.

Thank you, and we are accepting new clients. If you or anyone you know would appreciate this level of detail and expertise, we will welcome an introduction.

#ddh